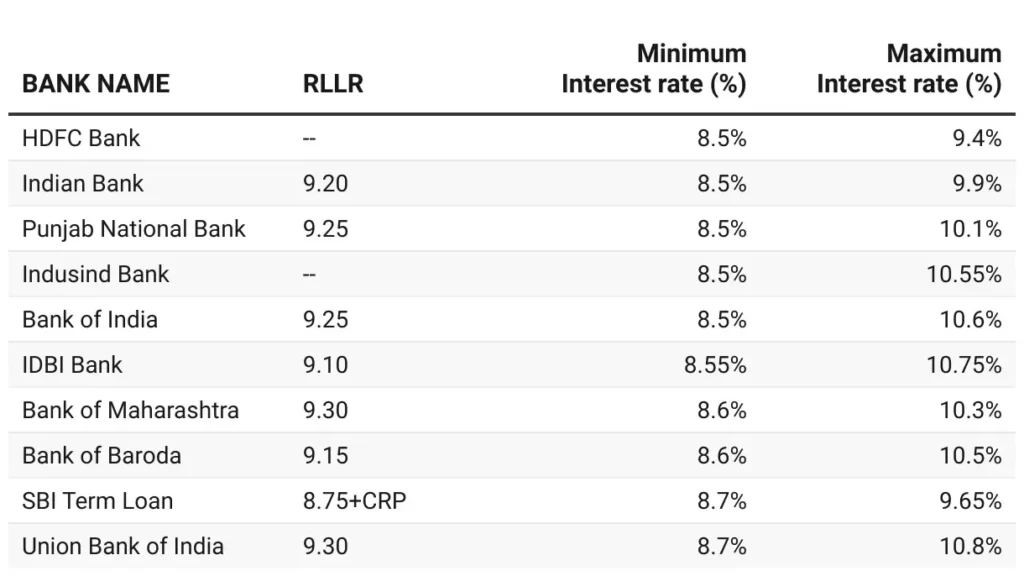

Home Loan Interest Rate : A significant number of commercial banks have chosen to adopt the Floating Rate system for home loans, aligning with the RBI’s repo rate. Home loan eligibility hinges on factors such as age, education, income, number of dependents, spouse’s income, occupational stability, asset portfolio, and the appraised value of the intended property.

The specific home loan interest rate is contingent upon the chosen bank. The RBI permits banks to levy a margin alongside a risk premium on top of the external benchmark rate. Hence, it’s important to acknowledge that the ultimate rate depends on the risk premium linked to your Cibil score and other variables.

- Advertisement -

Outlined below are the top 10 banks extending the most competitive Home Loan Interest Rate to borrowers in August 2023.

EMI Structure Repayment of the loan occurs through Equated Monthly Installments (EMIs), encompassing both principal and interest components. The EMI-based repayment begins the month subsequent to the full disbursement.

Determinants of Floating Rate Within the floating rate system, EMI amounts adjust in response to fluctuations in market interest rates. If market rates rise, your repayment amount increases, and conversely, decreases when rates decline.

Applicable Charges Banks usually impose a one-time fee on specific home loan products, which is separately paid by the borrower and not deducted from the loan amount. This fee is designed to cover the lender’s or bank’s expenses related to loan processing. Some banks may waive these processing fees as part of special promotions.

Additional charges encompass: As per the Bank of Baroda website, the following charges may also be applicable alongside the processing fee:

- Advertisement -

- Document verification/vetting charges

- Pre-sanction inspection (Contact Point Verification CPV) charges

- One-time post-inspection charges

- Legal opinion advocate charges

- Valuation charges for property assessment

- Bureau report charges

- CERSAI charges

- ITR verification charges

Is Prepayment of Loan Allowed? As per RBI’s home loan FAQs, “Most banks permit you to prepay the loan before the stipulated schedule by making lump sum payments. However, many banks levy early repayment penalties of around 2-3% of the outstanding principal amount. The prepayment penalty may vary based on the reasons and source of funds. Notably, if you secure a loan from another bank for prepayment, the charges are usually higher than when using your own funds.”

FAQ :- Home Loan Interest Rate

Home Loan Interest Rate ICICI Bank ?

Home Loan Interest Rate ICICI Bank 9.25% to 10.05%.

Home Loan Interest Rate HDFC Bank ?

Home Loan Interest Rate HDFC Bank 8.50% to 9.40% .

Home Loan Interest Rate of state bank of india ?

home loan interest rate of state bank of india 8.7% to 9.65%